Hurricane Preparation & Safety Tips

Protecting your home, family, and valuables from severe storms.

Expert insights from our loss control team

Myths and truths about hurricane preparedness

Our loss control experts debunk common myths versus realities on hurricane preparedness to ensure you're ready for anything the storm brings.

Watch hereHow to prepare for a hurricane

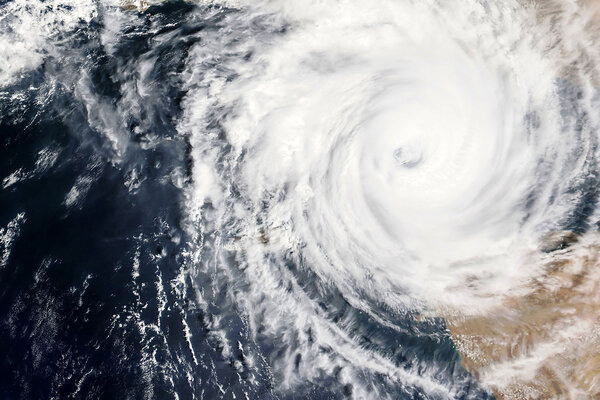

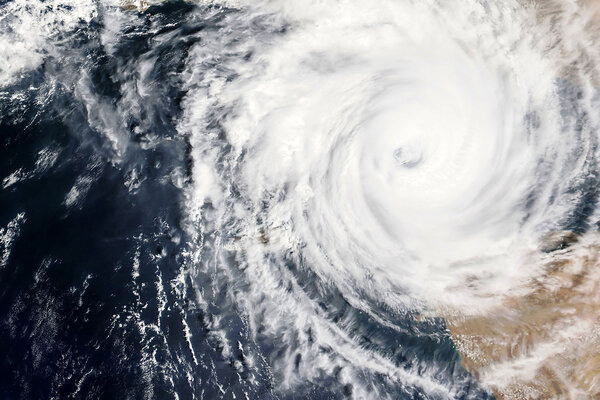

Hurricanes bring extreme winds, flooding, and destruction.

With the proper preparation, you can reduce the impact. Comprehensive hurricane preparedness includes key steps to take before the storm, staying safe during it, and tips for a quick recovery afterward.

Resources to help you at every stage

Be ready before the storm strikes

Contact us

Before, during, and after the storm

Your hurricane safety guide

A hurricane can be a devastating experience for anyone. Knowing how to prepare for a storm in advance can help protect you and your family, reduce the damages to your property and alleviate personal hardships.

Hurricane Safety GuideInsights on climate and catastrophes

Four key strategies for the changing reality of natural disasters

In recent years, weather and climate disasters have become increasingly frequent and severe, with many events causing at least $1 billion in damages. These events include everything from winter freezes and wildfires to droughts, floods, tornadoes, tropical cyclones, heat waves, and hailstorms. What’s striking is that many of these disasters have affected areas that were not previously considered vulnerable and highlight that natural disasters no longer follow predictable patterns. The reality is that every region is at risk. Climate change and shifting weather patterns have brought significant weather events to areas they never threatened before: Tornadoes in the east: Systems once centered in the plains are now migrating to states as far away as Wisconsin and Georgia. Winter storms in Texas: Deep freezes, the worst lasting weeks, are now near-annual occurrences. Wildfires in high-rainfall states: Look at Hawaii’s unprecedented event in 2023. Flooding in the southwest: Most recently, normally arid areas of Arizona were deluged after record snowfalls in the Rockies resulted in unmanageable runoff. Wind has become a critical factor in the majority of natural disasters s unrivaled speeds and changing patterns turn small fires into uncontainable events and broaden the strength as well as the reach of hurricanes. Since all signs suggest this pattern will continue, we believe that the best path forward is for all clients, wherever they live, to be proactive in their natural disaster risk management planning. More so for types of damage, they might not historically think to expect. Here are four key trends we’ve identified as crucial for today’s natural disaster risk management: 1. Have a maintenance plan If your local area has not been impacted by weather-related events in some time, it’s easy to let related maintenance fall by the wayside. However, as damage-causing events are more common than ever, it’s important to stay vigilant. This includes: Safeguarding the exterior: Once the barrier to your house is broken, damage can increase exponentially. So, keep trees trimmed, clear brush and clean gutters, inspect the roof, siding, windows, and repair as well as caulk as needed. Inspecting the interior: Maintain furnaces and replace filters, replace rusted parts in water heaters, and install automatic shut-off devices on water lines. 2. Backup power is now essential Prepare for a potential loss of electricity with a diesel or propane generator. (Solar panels are not necessarily the best solution, because they can be ripped off and rendered useless by wind and convective storms.) Utilities now shut off power preemptively, especially when winds are strong, to decrease wildfire risk. At the same time, weather-event-induced outages last longer and reach further. Without power, your property quickly becomes even more susceptible to damage and loss: alarms don’t function, mold sprouts, and water lines freeze. 3. Establish an evacuation plan In emergent situations, the people who have already mapped out and practiced evacuation routes are often the safest. So, the best time to create those plans is right now before any threat is imminent. When developing this plan, be sure to document all the details and share this with your property managers and caretakers to ensure everyone is well-practiced and informed: Artwork: Get custom crates crafted to hold your most important pieces and purchase fireproof blankets for outdoor sculptures. Create a fireproof bunker to store the pieces if that’s feasible. If not, arrange for a location to store your collections so they are well protected. Cars: Construct a weather- and fire-proofed garage, or secure a safe place off the property, preferably an inland location. 4. Create an inventory list In the event of a loss, you will be asked to present an accurate inventory with any claim you make. You can hire a professional for the task or do it yourself; be sure to include photos as important pieces of visual documentation. At the very least, make a video as you go from room to room, capturing all your valuable pieces. Ensuring the security of your inventory is crucial. Storing in a hardware wallet, akin to a flash drive, provides robust protection, even in the face of natural disasters. Given the impact of significant weather events felt across the country, taking a proactive role in your property’s risk mitigation not only minimizes the possibility of significant loss but helps make your property more insurable. With limited coverage options and carriers evaluating potential customers so closely, a well-maintained home with a detailed risk management plan could be a deciding factor. If you have any questions about preparing your home for natural disasters or other risk mitigation concerns, don’t hesitate to reach out. ...

More info

What you need to know about wind coverage

These days, the proverbial “winds of change” have transformed into literal threats, causing significant and escalating wind-related damage. This damage is no longer confined to traditionally affected areas. To mitigate exposure, insurance carriers are now reducing coverage, which could impact your insurance program, regardless of your property’s location. Here are four key points to understand about wind coverage— and what actions you should take in the face of these shifting currents. 1. Wind damage escalates quickly. Severe winds can turn everyday objects, like lawn furniture or garbage cans, into dangerous projectiles capable of breaking windows. Once the integrity of your home is compromised, it can create a vacuum effect that sucks in debris and water, leading to extensive structural damage. Similarly, tiles torn from the roof by wind can open a hole, allowing rain to pour in and cause significant water damage. 2. High-wind events are impacting more regions. Climate change is leading to more frequent and severe wind events, even in areas that were previously unaffected. While Southern coastal areas like Florida, the Carolinas, and Texas are still most at risk, regions further north and inland have also been impacted. Hurricanes are becoming stronger, with more Category 4 and 5 storms. The Midwest, meanwhile, is also undergoing greater wind damage from intense convective storms and tornadoes. In all cases, weather models predict these trends will continue. 3. There are effective strategies to help windproof your property. Making your property as windproof as possible is crucial to minimize the likelihood of loss and maximize insurability. Even properties in high-risk areas can be better protected against Category 5 winds with the right measures. Many high-risk areas, like parts of Florida, have strict building codes that offer guidelines for wind proofing. Key protective measures include: Securing roofs: Regularly inspect roofs and address repairs promptly. Ensure roofers follow guidelines for nail-spacing and materials designed for high-wind resistance, and that construction conforms to the latest codes. Strengthening windows: Install high-wind-resistant windows or hurricane shutters. Clearing exteriors: Trim trees and branches near structures and regularly remove debris throughout your property. Before a storm, bring in outdoor items like lawn furniture, garbage cans, and anything else that could be tossed around. 4. Collaborate for the best coverage. Much like wildfire insurance in California, carriers are becoming increasingly cautious about covering wind-related damage. This trend, which began with the destruction caused by Hurricane Andrew in 1992, has led to more restrictive coverage each year. Wind coverage is generally a component of homeowner’s insurance, but some states, such as Florida, carriers can separate it, offering it with higher deductibles or excluding it altogether. Securing wind coverage can be both challenging and costly. Working closely with your broker is essential to determine the best strategies for covering both existing and potentially new properties. Our team has deep expertise in this market, which makes us best positioned to secure coverage for you, either through discrete policies or creative outlets like non-admitted insurance companies. Likewise, we are prepared to fight for your claims in situations, both clear-cut and otherwise. In today’s climate, understanding the specifics of your insurance policies is more crucial than ever. Many clients are opting for higher deductibles, hurricane deductibles, and certain limitations or exclusions to lower their premiums, which can leave them more vulnerable after a storm. If you have any questions about wind protection or your coverage, please reach out at your earliest convenience. ...

More info

The impact of natural disasters on the insurance industry

With predictions of another season of significant weather events in the air, it’s important for us to give you an update on the current insurance landscape. The insurance industry is constantly evolving due to many factors and our goal is to keep you fully informed so you can better understand what is happening, why, and what you can do to mitigate the impact on your insurance program. The insurance industry is in the midst of a correction that largely began in California a few years ago and continues to spread across the country, particularly to regions most susceptible to wildfires, hurricanes, and other catastrophic climate events. Despite this, Americans continue to move into these areas, and that has put a serious strain on insurance carriers, which, in turn, is increasingly impacting even less-vulnerable areas. In the past five years, the U.S. has experienced 89 weather-related events that caused at least $1 billion in damage, and that trend is not abating. In 2022 there were 18 separate billion-dollar events making it the third most costly year on record for hurricanes, freezes, severe storms, wildfires, and floods. Floods, in fact, are the country’s most frequent and costliest natural disaster, now occurring often in areas not previously considered to be high-hazard ones. All of which means premiums continue to climb higher, non-renewals are more common than ever, and it is increasingly difficult to obtain coverage, wherever you live across the country. This is no doubt, frustrating news to clients but does have a silver lining: Several years of navigating this market has made our team extremely well equipped to guide you through its challenges and find creative solutions best fit for your unique needs. Three factors driving the market correction Insurance carriers engage in a constant struggle to sustain an economic model that allows them to pay the broadest number of claims. This moment in time remains a particularly tricky one for them because … 1. Capacity is low. Today’s carriers are significantly overexposed after decades of securing increasingly expensive homes in areas that have borne catastrophic losses from weather events. Even premiums that may seem unreasonably high to individual policyholders do not sufficiently cover carriers’ aggregate risk. Not only has this overexposure made carriers tighter with rates, but it has also made them more likely to refuse coverage altogether. This is the case in affected and unaffected areas alike, especially for owners of older homes that are not fitted with the latest protections or do not meet current building codes. A similar reluctance is occurring in areas like New York City, where aging infrastructure makes carriers wary. 2. Reinsurance costs are high. If carriers were left to pay off losses solely with the money they took in from premiums, insurance would be unsustainably expensive. That’s why they support their own exposure with reinsurance, essentially, coverage for losses they can’t cover on their own. Reinsurance guarantees carriers have enough cash no matter the cost of a loss. That said, the current combination of increased catastrophic events and heavier concentrations of multi-million-dollar homes in vulnerable areas impacts both insurance and reinsurance carriers. In fact, so drastically, reinsurance is now much costlier than before. When those rates rise, it makes it that much more complicated and expensive for carriers to provide adequate coverage for clients. There comes a tipping point when reinsurance becomes just too costly, especially government-regulated ones that are required to carry a certain surplus. 3. Inflation is making everything worse. The cost of replacing almost everything is significantly higher these days. Labor and materials are at sky-high prices because of ongoing supply-chain issues and skilled-worker shortages. Vehicle repair costs, to take one example, have risen steadily, and faster, in the past two years. The latest premium appliances may be more technologically advanced, but that also makes them more expensive. Much more basic materials such as paint, lumber, roofing and plumbing are pricier, too. And these costs continue to climb higher after a catastrophic event which puts pressure on available resources. Smart risk management strategies We continue to provide innovative solutions to help protect you and your belongings. But we also want to put you in the best possible position to ride out these challenging times. Specifically, we recommend that you… Do everything in your power to avoid a loss. Yes, accidents and climate events will unfortunately happen, but you can better prepare your home and property for both. Simple pre-emptive steps such as creating a brush-clearance zone in a wildfire-prone area or undergoing a windstorm mitigation inspection in storm-heavy areas are crucial. We can also help you schedule walk-throughs with professionals, who will spot potential trouble areas and recommend preventative measures. Likewise, we encourage you to embrace the available technology to minimize the likelihood of water loss or wind damage such as water leak detection devices and more. Protect your insurance coverage. A history of previous claims, even a short one, is often a strong predictor of premium hikes and non-renewals. It can also make it more difficult to secure new coverage. Thus, we encourage you to speak with your insurance professional prior to making any potential claim, so we can help you decide how best to proceed. (In some cases, that means taking on the expense yourself if possible.) Choose coverage strategically. If, as we suggest, you plan to file claims only in the most onerous scenarios, you can lower premiums by choosing higher deductibles. Other situations may call for you to self-insure or partially insure. For example, if your home has the best-possible wind protection and you do not carry a mortgage, foregoing wind coverage to make the premiums more reasonable might be a viable option. Contact us before signing a contract on a home: If you are considering buying in a risky geographic area, your broker can tell you if you will be able to purchase coverage—and whether the cost will be prohibitive. We understand that this is an extremely challenging market, but we are confident that we can help guide you to make it more manageable. If you have any questions about the current state of the market or whether your personal portfolio is adequately protected, please know we are always here to help guide you and your family. ...

More info

How climate change is impacting your insurance program

From deep freezes in Texas to wildfires in California, extreme weather is causing a tempest throughout the industry: premium increases, non-renewals, difficulties in obtaining coverage. The impact is neither limited to the hardest-hit regions, nor is it likely to go away soon. Understandably, many of our clients have been asking how it all will affect them. This overview explains exactly what’s happening and why, and suggests how to minimize the consequences on your personal insurance portfolio. Today’s weather report Extreme climate events—hurricanes, wildfires, tornadoes and the like—are occurring more frequently than ever. According to the United Nations Office on Disaster Risk Reduction, there were 4,212 recorded disaster events worldwide between 1980 to 1999; from 2000-2019, the number was 7,348. At the same time, weather forecasting has become less accurate, unable to keep up with the growing unpredictability of climate-change-induced events. That makes it even harder to prepare for the worst. Furthermore, today’s extreme weather often lasts longer and is more intense, which, in turn, causes even more damage. Shifting winds in the insurance industry The unpredictability of these catastrophic events has made it harder for insurance carriers to confidently take on additional risk. Informed by updated actuarial data, they have begun to rebalance their portfolios by determining where they are over-extended. California is a prime example as the wildfires are affecting larger areas and destroying entire neighborhoods across the state. This is resulting in multi-billion dollar claims year over year. Multiply that by the 7,000+ catastrophic events over the past decade and you can see the imbalance that carriers are now trying to correct. That correction manifests as an increase in premiums, and possibly non-renewals, for everyone, regardless of where they live. What that looks like in practice is this: Premium hikes across the board, regardless of history, type of home and most important, location. These increases have nothing to do with whether the particular situation of any one client warrants them. Carriers are simply protecting their profitability, making sure they are collecting enough to cover their exposures and higher reinsurance fees. Declined policies for properties with any negative history at all, even if that history predates the current ownership. Preventative and protective measure requirements such as for backup generators, low-temperature sensors and water shut-off systems. A much more particular view of risk assumption. For example, a carrier might prefer to insure one $2 million home rather than two $1 million homes in an attempt to minimize its exposure. Riding out the storm The best way to counter this industry retrenchment is to make your account look as appealing as possible to underwriters. Here are some things that can help you accomplish that: Talk to your broker as soon as you begin to think about buying a home: The earlier, the better. Brokers can help you understand exactly what the coverage situation is in whatever locations you are considering. They will present the potential costs of living in a region prone to cataclysmic events and in those that may be secondarily affected by the newer climate-related fluctuations in the market. Limit your claims: Of course, you want to be compensated for every loss, but consider only putting in claims for large or severe losses which will eliminate headaches down the line. If you put in claims frequently for small dollar amounts, your program may be less appealing to carriers and could result in being non-renewed. Sustaining even a $50,000 loss without reimbursement, can leave you in a better position at renewal time. Raise your deductible: If you do decide you can make claims only for major losses, you can then lower your premiums by choosing policies with higher deductibles. You can also receive breaks on premiums if you comply with various carrier-requested safety measures, such as the installation of leak detectors and backup generators. Build smarter: If you are starting from the ground up, your first call should be with your broker. Together you can both vet your architect and contractor not only for aesthetics and cost, but also on their knowledge of resiliency. You want them to be well versed on all the latest protective measures and technologies. Ask them to show you examples of previous relevant projects and to outline the steps they expect to take to fortify yours. Unfortunately, climate change is the new normal, which means insurance carriers will continue to be caught in a bind: how to help prevent overwhelming losses while sustaining a successful business. At the moment, there is just no obvious and clear path through the increasingly unpredictable and destructive forces of the weather. Until the skies clear, we are using our extensive experience and technical know-how to manage this difficult market, helping clients mitigate premium increases and finding alternative coverage in the worst cases. If you have any concerns, please do not hesitate to reach out. ...

More info